According to recent reports, the nation’s unemployment rate is at a historic low. This is creating a new normal where corporate America’s job opening demands can outweigh the candidate supply. The fact is that for the first time in years, the nation’s multigenerational workforce is in the driver’s seat — and in my experience, health and medical benefits are weighted equally with salary requirements. This is why I tell small businesses looking to grow that it is critical they embrace health and wellness benefits to recruit and retain top talent.

Author Archives: Admin

Insurance Job Titles and Descriptions

Insurance is a broad work category that includes several types of coverage’s, including life and health insurance, casualty insurers, insurance brokers, and more. The field encompasses many job titles.

Why Addiction Rehab is Covered by Most Health Insurance Plans

There are multiple paths to help those struggling with addiction receive treatment. Depending on the structure of the treatment program, in-patient treatment is likely the most expensive. For those with private or employer provided health insurance, that plan will likely have an addiction recovery payment requirement.

70% of Employers Offer Packaged Health, Dental, Pharmacy Benefits

Seventy-one percent of employers with 100 or more employees are either actively integrating or considering integrating their medical, dental, vision, and pharmacy benefits under their health and wellness programs in the next five years, according to a study commissioned by Anthem and conducted by TRC Insights.

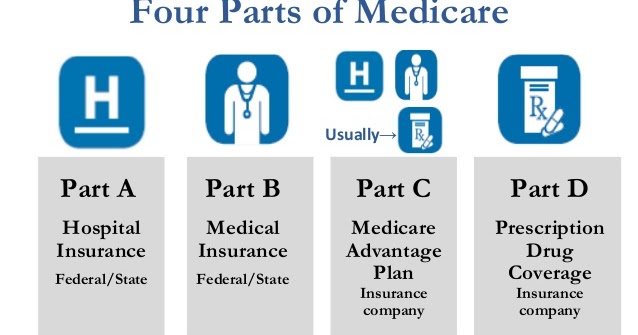

The parts of Medicare (A, B, C, D)

There are four parts of Medicare: Part A, Part B, Part C, and Part D.

Facts About Medicare

Medicare is a federal health insurance program that pays for a variety of health care expenses. It’s administered by the Centers for Medicare & Medicaid Services (CMS), a division of the U.S. Department of Health & Human Services (HHS). Medicare beneficiaries are typically senior citizens aged 65 and older. Adults with certain approved medical conditions (such as Lou Gehrig’s disease) or qualifying permanent disabilities may also be eligible for Medicare benefits.

What is mental health?

Mental health refers to our cognitive, behavioral, and emotional wellbeing – it is all about how we think, feel, and behave. The term ‘mental health’ is sometimes used to mean an absence of a mental disorder.

The Basics of Life Insurance

That’s hardly surprising, given that so many have coverage through their employers, or that there are a multitude of online insurance aggregators promising you huge insurance policies for just a few dollars a month.

Insurers Want to Know How Many Steps You Took Today

A smartphone app that measures when you brake and accelerate in your car. The algorithm that analyzes your social media accounts for risky behavior. The program that calculates your life expectancy using your Fit bit.

The future of group life insurance in the United States

The industry is changing. To be successful in the coming decade, insurers will need to deliver distinctive consumer experiences and value-adding tools for brokers.